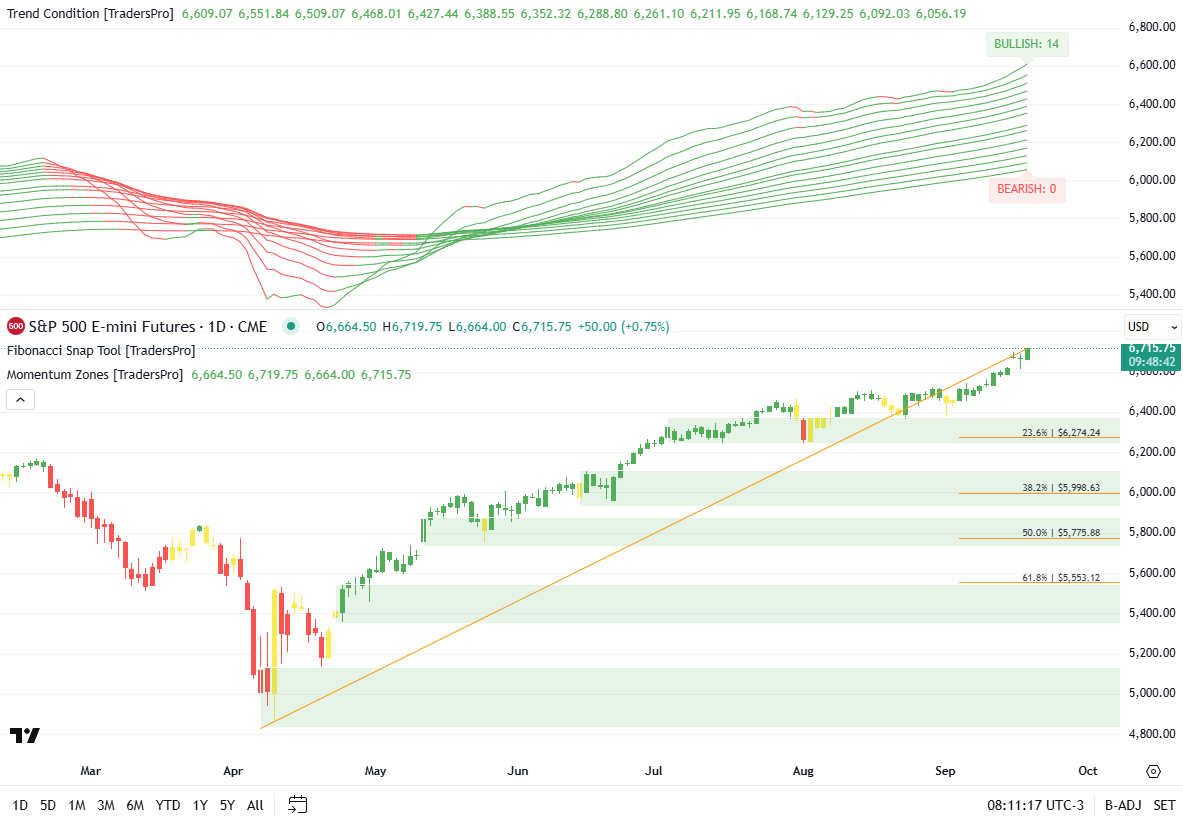

Uptrend Persists with Clean Higher-High Structure

S&P 500 futures break higher with full-bullish breadth and widening momentum, keeping pullbacks shallow while compression would be the first sign of consolidation.

New To TradersPro?

Market Overview:

Futures push to fresh highs as breadth stays max-bullish and price holds above shallow retracement support.

Bullish/Bearish Trend Analysis

Trend Condition:

Bullish Trends: 14

Bearish Trends: 0

Overview: The market is bullish, with 14 trend lines signaling upward momentum.

Trend Condition

Current Trend State:

The 14-line trend stack is expanding.

Width: wide.

Implication: A wide, rising stack supports trend follow-through and quick, shallow dip-buys.

Probability Outlook:

Continuation: ~64% chance while width < extreme.

Consolidation / Pullback: ~36% chance if width enters “very wide”.

Price Action and Momentum Zones

Current Price and Change:

Currently, the S&P 500 Futures are at 6,715.75, up by 50.00 pts or 0.75 %.

Market Behavior:

Breakout tone; buyers defending and pressing higher along the rising trendline.

Momentum Zones:

Price is holding above the 23.6% momentum band and well above the 38.2–61.8% corrective zone, keeping pullbacks contained.

Fib Retracement Levels

Current Position Relative to Levels:

The market is above the 23.6% Fib retracement.

Key Fibonacci Levels:

23.6 % → 6,274.24

38.2 % → 5,998.63

50.0 % → 5,775.88

61.8 % → 5,553.12

Analysis:

Trading north of the shallow retracement affirms the prevailing uptrend; only a close back into the 23.6% band would hint at a broader pause.

Overall Market Interpretation

Bigger-picture uptrend remains intact with maximum bullish breadth and expanding momentum spacing. Near-term risk centers on ribbon compression rather than immediate downside.

Summary

Strength persists: breadth is fully bullish, the ribbon is widening, and price rides the uptrend above shallow support. Watch for compression or a slip into the top band as the first consolidation tell.

New To TradersPro?

Bonus - 3 Stocks on the move today

Follow on Social Media

Understand Your Risk