Matthews International (MATW): Battery-Component Momentum Builds

MATW is benefiting from strengthening industrial demand and growing opportunities in engineered materials and energy-storage technologies.

New To TradersPro?

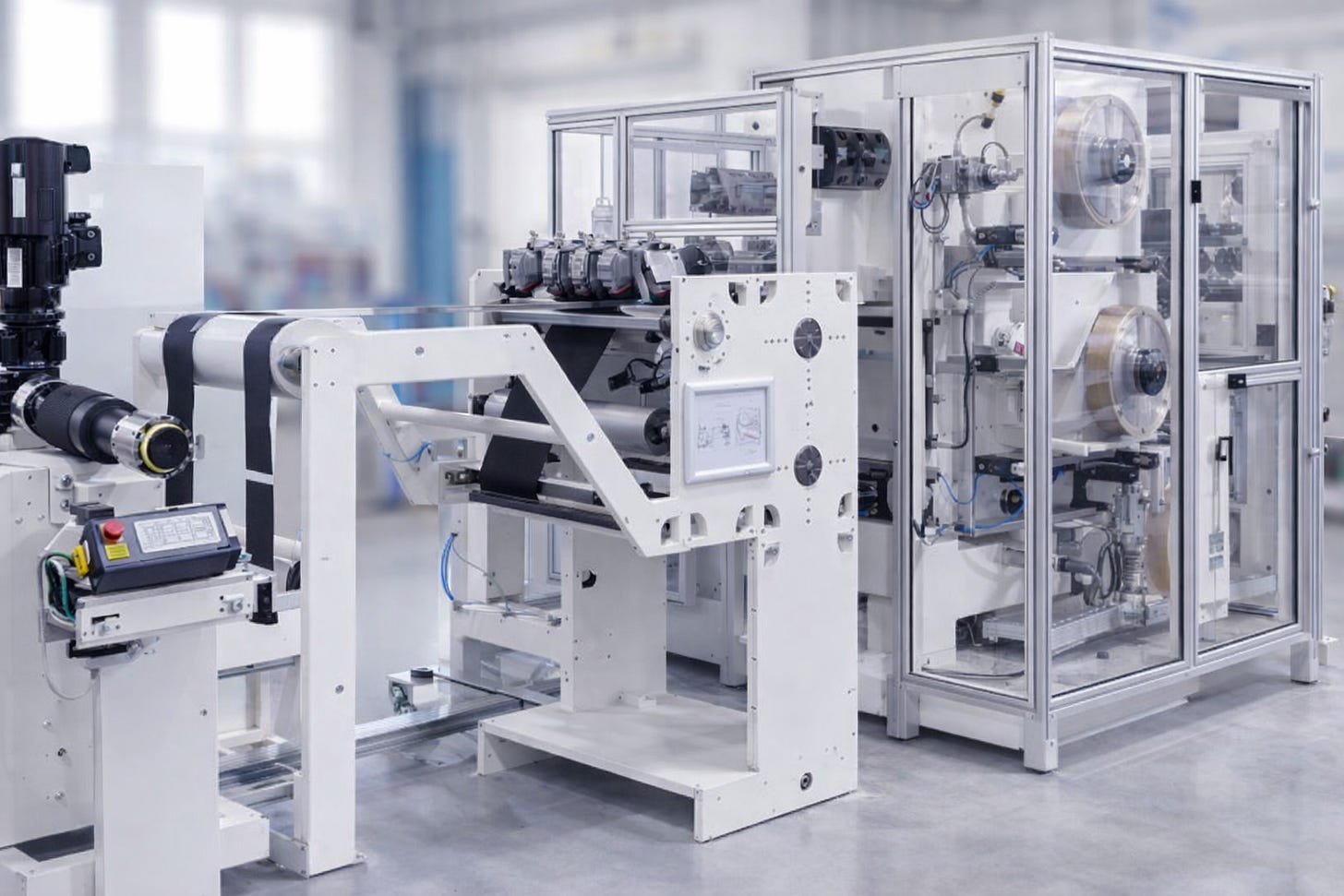

Matthews International Corporation (MATW) develops products and services that span memorialization, industrial technologies, and brand solutions. The company’s mix of manufacturing, advanced marking systems, energy-storage components, and digital workflow tools creates a steady foundation in both traditional and emerging markets. Growth today is being driven by demand for engineered materials and battery-related components, along with modernization across its legacy memorialization segment.

Shifts in manufacturing and reshoring trends have been meaningful. Companies looking to upgrade automation and traceability systems are turning to providers with proven industrial technology capabilities, giving MATW more room to expand its engineered offerings. At the same time, the continued build-out of domestic battery and energy-storage infrastructure has opened new long-cycle opportunities.

Inflation pressures have softened relative to prior years, and that stability supports companies operating in heavy manufacturing. More predictable input costs can help MATW maintain margins as it scales newer product lines. These same conditions also encourage customers to resume delayed capital-equipment spending cycles.

On the chart, MATW shows a clean confirmation bar backed by rising volume, signaling buyers stepping in with conviction. The move into the momentum zone suggests the trend is strengthening rather than fading.

A trailing stop helps manage that trend by adjusting as price makes new highs, and traders often set it along Fibonacci levels using the snap tool to stay aligned with the stock’s structure.

For more information about this company visit their official website.

New To TradersPro?