Market Overview:

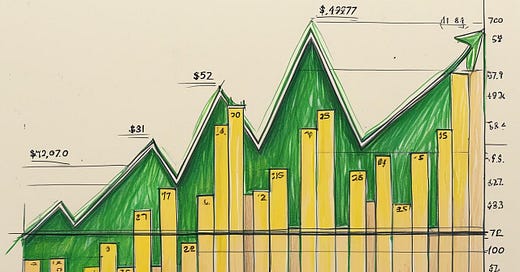

Welcome to today’s market overview. The chart shows the S&P 500 Futures holding above key Fibonacci support, with strong bullish momentum dominating today's session.

Bullish/Bearish Trend Analysis

Trend Condition:

Bullish Trends: 14

Bearish Trends: 0

Overview: The market is strongly bullish, with all 14 trend lines signaling upward momentum and zero bearish trends in play. This reflects dominant buying pressure and no sign of selling strength.

Chart by TradingView

New To TradersPro?

Learn About Premium Services

Price Action and Momentum Zones

Current Price and Change:

Currently, the S&P 500 Futures are at 6,439.75, up by 15.25 points or +0.24% from the previous session.

Market Behavior:

Price action remains steady to the upside, with buyers defending recent highs. No significant selling pressure is visible at this stage.

Momentum Zones:

The market is trading well above the 23.6% retracement level, firmly in the bullish momentum zone. A pullback into the 38.2%–61.8% range (5,836–5,453) would represent a corrective phase, likely to be met with renewed buying interest.

Fib Retracement Levels

Current Position Relative to Levels:

The market is currently above the 23.6% retracement level, maintaining strong bullish control.

Key Fibonacci Levels:

23.6% → 6,074.07

38.2% → 5,836.71

50.0% → 5,644.88

61.8% → 5,453.04

Analysis:

Holding above 6,074 keeps bullish momentum intact. If price dips below this level, a corrective pullback could develop toward 5,836 or 5,644, where buyers may attempt to regain control.

Overall Market Interpretation

The broader trend remains firmly bullish, with no bearish signals present. Price continues to trade near highs without a clear resistance cap, suggesting room for further upside unless momentum falters below the 23.6% support level.

Summary

The S&P 500 Futures are showing strong bullish momentum early in the session. The broader trend remains bullish, with 6,074 serving as a key support level to watch. As long as price holds above this level, the market’s upward bias is expected to remain intact, with buyers aiming for new highs.

Where Breakouts Begin: The Strategy for 100%+ Gains

Before a stock surges, there’s a pattern. This method shows you how to spot it, time it, and ride it — without sitting at your screen all day. [Unlock Strategy]

These updates apply the Momentum Model principles. If you want to learn the full system behind the signals, the full training course walks you through it step-by-step.

[Learn the Method - Trading Course]

New To TradersPro?

Learn About Premium Services