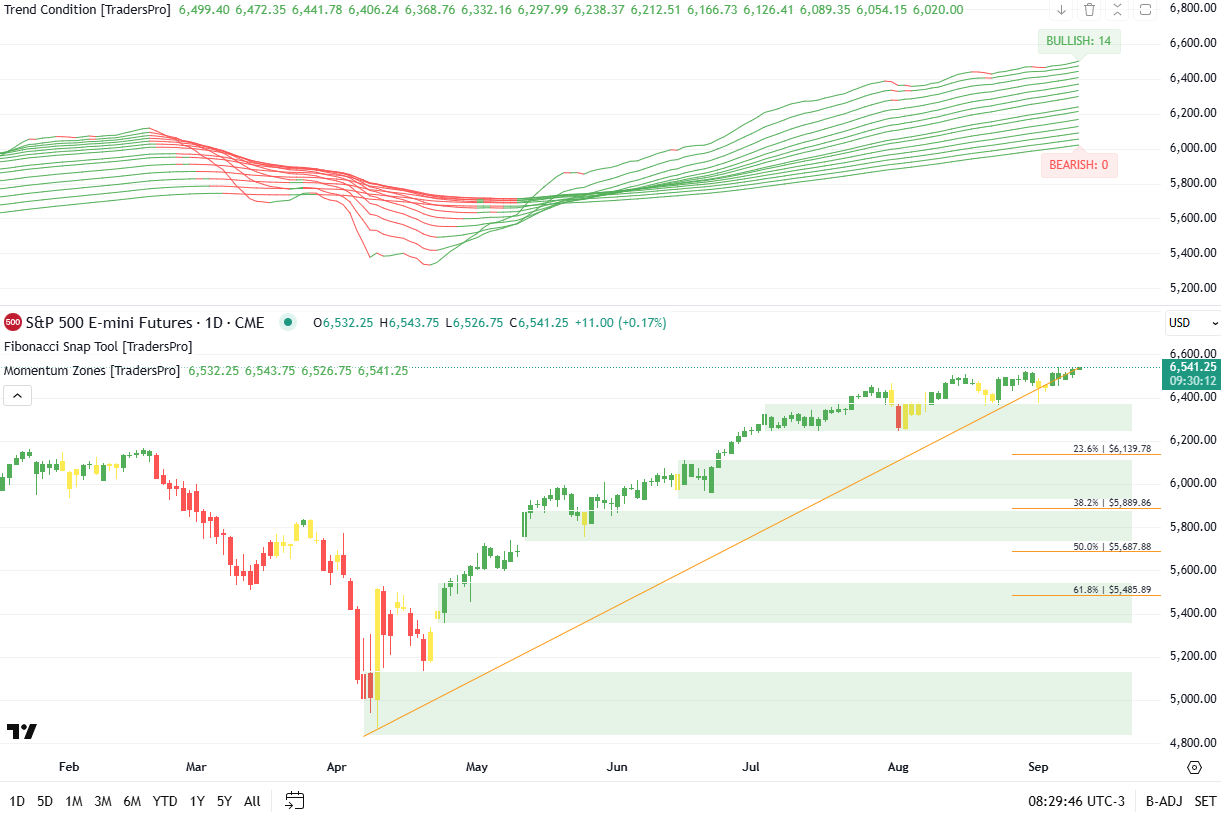

Breakout Potential Builds While Support Holds

A wide, expanding trend stack keeps the advantage with bulls, though compression or a clean support break would pivot expectations toward consolidation.

Market Overview:

Futures continue to hold a high-level range with a fully bullish trend stack and price perched above the momentum zone.

Bullish/Bearish Trend Analysis

Trend Condition:

Bullish Trends: 14

Bearish Trends: 0

Overview: The market is bullish, with 14 trend lines signaling upward momentum.

Trend Condition

Current Trend State:

The 14-line trend stack is expanding.

Width: wide.

Implication: Wide, rising bands favor a steady, buy-the-dip advance and controlled grind higher.

Probability Outlook:

Continuation: ~58% chance while width < extreme.

Consolidation / Pullback: ~42% chance if compression resumes or momentum support breaks.

Price Action and Momentum Zones

Current Price and Change:

Currently, the S&P 500 Futures are at 6,541.25, up by 11.00 pts or 0.17%.

Market Behavior:

Steady; buyers defending shallow dips near range highs.

Momentum Zones:

Price is holding above the 23.6% “momentum band,” with the 38.2%–61.8% area below acting as the corrective demand zone.

Fib Retracement Levels

Current Position Relative to Levels:

The market is above the 23.6% Fib retracement.

Key Fibonacci Levels:

23.6 % → 6,139.78

38.2 % → 5,889.86

50.0 % → 5,687.88

61.8 % → 5,485.89

Analysis:

Remaining above the momentum band keeps the primary uptrend intact; a loss of that area would open room for a routine pullback into deeper support.

Overall Market Interpretation

Structure is constructive: all-green ribbon, wide spacing, and price pressing the upper base. Sideways-to-up remains the path of least resistance unless the ribbon tightens and first support fails.

Summary

Bulls retain control as bands widen and price rides above momentum support. Expect a measured grind higher with buy-the-dip tone, unless compression returns and initial support breaks.

The Strategy That Took One Trade From $7.60 to $30+ — Step by Step

Real trade. Real results. See how a rules-based system spotted momentum early, mapped exits in advance, and captured a 300% move — all with structured risk. [Unlock Strategy]

Bonus - 3 Stocks on the move today

Follow On Social

Understand Your Risk